Half of New York’s Counties now make parcel data available for free through Open Data efforts though barriers in specific governments still need to be overcome before statewide data is available

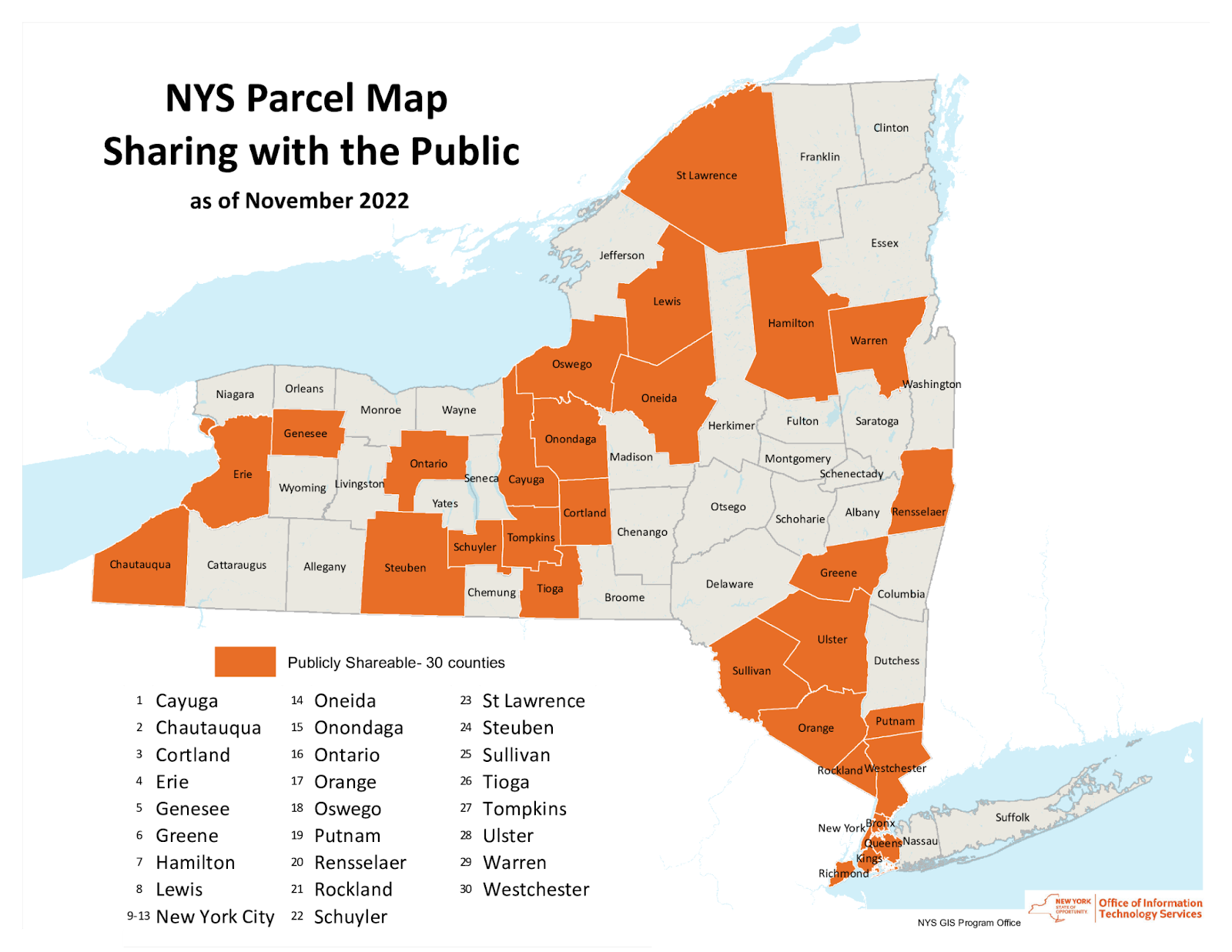

Not too long ago, I was communicating with a colleague about how some governments still, in 2023, continue to charge or license tax parcel data. At first, somewhat amazing considering how far the Open Data movement has come over the past 10-15 years across the Empire State. As recently as late 2022, information from the NYS GIS Program Office, which monitors the availability and sharing of tax parcel data statewide, shows that nearly 50 percent of NYS counties are making tax parcel data available for free through various means. Great strides being made perhaps suggesting that one day the barriers prohibiting the sharing of parcel data across the entire will finally be nonexistent? And that the gripes and complaints I was sharing in conversation with my colleague would go away.

Or maybe not.

Since November 2022, this map has been updated and NYS GPO now notes that half of the statewide counties currently share tax parcel data

Issue Was Discussed Early On – What Happened?

In the early days of statewide GIS development (circa 1990s) the GIS community was fortunate to have Bob Freeman, former Executive Director of the New York State Commitee on Open Government (COOG) participating in the growth of the GIS movement. Bob seemingly recognizing and witnessing the formation of a technology which would have a tremendous impact on government records and data. Almost knowing that as part of the new technology, digital versions of data would become just as important or even more valuable than hardcopy format. He was involved in statewide GIS conferences and contributed in many ways. All said and done, he was a staunch advocate of making GIS data available – largely long before the “Open Data” concept was framed.

I was only able to find a few of his opinions searching the COOG archives and ultimately reached out to the current COOG Executive Director Shoshana Bewlay to both bring to her attention of governments still charging for tax parcel data as well as to see if she, or her staff, might be interested in revisiting the issue. I heard back promptly from Kristin O’Neill, Assistant Director who was kind enough to send me a link to all of the COOG opinions (7) which included “GIS”. The links to all of the GIS-related opinions are below which can either be read through in its entirety or skimmed-over. There is a lot here some of which is better interpreted by an attorney. 7507, 11230, 13575, 14366, 15058, 15695, 19246. Looking back, I’m not sure why I thought the issue had gone further along in the legal system and had been resolved to a more definitive degree. But these few opinions suggest otherwise.

More than once, COOG responded to the question/issue of an individual or organization questioning the basis of a government organization either selling or licensing tax parcel data. And in general, each time, the COOG response – or opinion – was the same noting that electronic records (digital) records are no different than hardcopy records and should be made available at the cost of duplication. (Keeping in mind original Freedom of Information Law (FOIL) costs of duplication were originally based on hardcopy records (i.e., for example 25-cents per page) and did not/does not have specific rates for digital data duplication. Today, staff time, tapes, etc., can be included in the charge. However, since COOG opinions are advisory in nature only in context of FOIL, the early inquiries did not result in any formal legal challenge being launched on any level against any entity with regard to the selling of tax parcel data. Suffolk County early on became involved in litigation on licensing/copyright issues (referenced in one of the opinions) which is still in place today. But by the late 1990s, the selling of tax parcel data was in place and had become business as usual. It seems the geospatial community is no further along in “the challenge” to the selling or licensing of tax parcel data than we were some thirty years ago.

Speedbumps Still Exist

And as we all know, statewide local tax parcel data isn’t the only government data product for sale. For example – and nothing implied – take NYS Department of Motor Vehicles (NYS DMV) and NYS Department of Health (NYSDOH). One could perhaps make the case its not the same. But maybe. The point is is that these government agencies and others elsewhere are selling data albeit under different circumstances. The precedent is in place and seemingly accepted by many.

My canvass of long time Empire State open data advocates do not seem too surprised of the current or continued “status” of statewide tax parcel data. Generally in agreement that, yes, COOG opinions can be useful to some degree as part of a strategy after a specific tax parcel FOIL request (and/or appeal) has been denied and a legal process has been initiated. Though the legal process is a major hurdle in itself as a legal challenge takes time, resources, and of course money – and/or a lot of pro bono work. As such, the statewide geospatial community still, for the most part, presumably awaits for this challenge to happen. By someone. Some entity. Some professional organization with the legal resources.

But maybe the issue has run its course. Now the consensus seems to be that the geospatial community will continue to wait for the counties in question to change their policies. Which could take forever. Or perhaps as we have seen over the past couple years across the state, the game changer may in fact simply be changes in administrations or through staff attrition to the next generation of government officials which support Open Data policies.

Perhaps a long wait for governments and nonprofits or other organizations with limited resources. Business and industry on the other hand, may find it easier and more cost productive to continue to buy the data – regardless of the price point. Had the NYS GIS Association ever established any kind of legal counsel capacity this would have been a great place to jump in. One could argue that had other professional associations with legal representation felt it worth their while to challenge the process of selling publicly-funded tax parcel data – we probably would have seen something initiated by now.

Little Doubt of the Value

Over the past several years, NYS GIS Program Office staff member Kate Kiyanitsa has been championing the open tax parcel data cause across the Empire State making numerous presentation to the user community and professional organizations. Her January 2021 presentation – not too old and still very relevant – to the New York State Association of Counties (NYSAC) entitled “Understanding How NYS GIS and Open Parcel Data Sharing Can Benefit Counties” provides an excellent overview – with real numbers and real examples – of the benefits of making tax parcel data openly available. One of my favorite points of discussion relative to the “selling data” issue is found on slide 19 which, to the extent possible, itemizes how much money Counties make selling tax parcel data. While these County budgets will show some boiled down version of data/map sales, you will rarely see definitely numbers from the same source as to how much money it costs to administer the sales program. Kudos to Kate and the GPO office for continuing their efforts in this regard.

And just by coincidence, this article coincided with the recent completion of BetaNYC’s annual Open Data Week. Of course which the citywide parcel database is central. You can see a week’s work of Open Data-focused presentations starting on this webpage and using the Next Events button on the bottom right. New York City’s Open Data ecosystem is quite impressive and built on top of the NYC Open Data Law which was signed into law in March 2012. Over a decade ago and a model to other governments across the state.

Summary

Much progress has been made in making tax parcel data freely available and open across In that nearly half of New York’s many counties have been selling the data for many the Empire State over the past 10-15 years. But much work still needs to be done by individuals and organizations. As well numerous institutional changes before the GIS user community recognizes full access to tax parcel datasets across the entire New York State footprint.

The glass is now half-full. Onward we go.

The GIS Program Office will continue to encourage counties to publicly share their parcel data and look for opportunities to promote open parcel data. After all, open parcel data benefits all New Yorkers. Thanks for highlighting this important issue, Sam!

Thanks, Lis! Was an interesting and fun article to put together. Went back many many years and spoke with a bunch of folks. Parcel data is at the foundation of nearly all of our collective geospatial applications. GPO office is so important in keeping this statewide effort moving forward.